Don’t get lost in the search for the best Forex Trading. It can be annoying, right? Chasing a single system all time will not worth the successful trade. The most powerful means of winning a trade is the Forex trading strategies portfolio put-forth by you in different conditions. It’s a mandate for you to get the basics right with all the pre-requisite of understanding financial economics. The idea of what a Trading Strategy means is any scheme that you put-in-place to decide when to buy or sell a currency pair. A Sound Risk Management technique, Fundamental Analysis and focused Technical Analysis compromises a better Forex Trading Strategy. For your ease, the Forex strategies can be sliced into a diverse organizational model, which helps you trace the most appropriate strategy.

Position trading is a long-run trading loom where you can grasp trades for a week or even months. The schedules that you’ll trade on are usually the Daily or Weekly. If you are a position trader, you mostly bank on fundamental analysis such as Elliot Wave Theory in your trading NFP, GDP, Retail sales, etc. to give preference. By using the Technical Analysis in the good sense, you can add flavour to your time entries.

For instance, you study the fundamentals of EUR/USD and settle on its bullish, as you don’t want to go long at any price. So, you wait for EUR/USD to come to Support before taking your position. Now, if your analysis is correct, you could get in at the start of a new trend before others. The Technical Analysis enriches entry and exit points.

You don't need to pay much time trading, as your trades are longer-term. The short-term fluctuations don't bother you much due to lesser stress in your trading. A pleasant risk to compensate on your trades, possibly 1 to 5 or more. It would be best if you had a firm head of fundamentals propelling the market. Need a more broad capital base because your stop loss is wide. May does not make a profit every year because of the low number of trades.

Hedging is a strategy that is usually employed to lessen the risk display in adverse price fluctuations. The idea behind currency hedging is to buy a currency and sell another, hoping that another trade’s profits will offset one trade’s losses. This strategy works most efficiently when the currencies are negatively correlated.

Thus, it would help if you bought second security aside from the one you already own to hedge it once it moves in an unexpected direction. Unlike most trading strategies already discussed, this strategy is not used to profit; instead, it aims to reduce the risk and uncertainty. However, even when the trades are hedged, you still may be at risk of suffering significant losses. Since buy orders are closed at the bid price and sell orders are closed at the asking price, spreads widening can increase the loss for both long and short positions.

What is more vital to note in currency hedging? The risk reduction always means profit reduction; herein, hedging strategy does not assure huge profits. Instead, it can hedge your investment and advise you to escape losses or reduce its extent. However, if rightly developed, a currency hedging strategy can result in profits for both trades.

Hundreds of economic news is published around the world every day. While some of these news events have little to no impact on the market, others are served by sharp moves and enhanced volatility. News traders attempt to foretell how the market is going to behave to an appropriate event. All events scheduled for the current or the coming week can be refined by impact, country, category and time. Since currencies are always traded in pairs, news from both countries involved should be taken into your thought.

The economic calendar is the prime tool a news trader operates to track the upcoming releases and predict how they can influence the market. You will also gain a financial news agency forecast that saw several economists concerning their opinion on a particular event. The more actual release data differ from the estimates, the brighter move you can await.

We can’t be very open on the Scalping Strategy unless we are pretty much clear about the Day Trading Strategy. So, let’s have some basics covered about the Day Trading Strategy.

Day trading strategy describes the action of buying and selling a security within the same day, which means that a day trader cannot hold any trading position overnight. In making day trading, you can carry out many trades within a day but liquidate all the trading positions before the market cessation. A vital factor in learning in day trading is that the longer you hold the positions, the higher your risk of loss will be. Depending on the trading style you choose, the price target may change.

Grid trading strategy entails setting pending orders at regular intervals above and below a predefined price level. It can be readily executed when there is no explicit bent and does not need reliable market direction forecasting.

The tabulation explains on how the functionality would be when you follow the Grid Strategy in your Trade

| LEVEL | ORDER | OPEN PRICE | LEVEL | ORDER | OPEN PRICE | HEDGE |

|---|---|---|---|---|---|---|

| 1 | Buy Stop | 1.25250 | -4 | Sell Stop | 1.24300 | -95 |

| 2 | Buy Stop | 1.25400 | -3 | Sell Stop | 1.24500 | -90 |

| 3 | Buy Stop | 1.25650 | -2 | Sell Stop | 1.24750 | -90 |

| 4 | Buy Stop | 1.25800 | -1 | Sell Stop | 1.24950 | -85 |

| Maximum grid loss (pips) | -360 |

The Martingale Strategy depicts a Cynical Rise System. Are you not an ambitious trader who always looks for a way to enhance your strategy or system? More often than not, amateur traders are incredibly concerned with entry signals, which can be detrimental to other vital areas.

Let's rewind the past a bit to understand the present. Martingale Strategy was into business in the 18th century for a betting strategy based on Probability Theory. The basic principle induced is to double the anytime you lose. Does it make sense? Yes, eventually, one champion bet will embrace all former losses. The same applies to the Forex Trading: the volume doubles whenever you use this strategy to fail to gain profit. If you are on the counter side of the market, you increase the volume twice in the hope of a breakout.

If your investment is large, the Martingale strategy can support the implied losses. Besides, this strategy might entail significant risk, and you may endure a stop out before recovering your losses or converting them into profit.

For instance, let say GBPUSD is currently at 1.30850 – Take a look at the table below.

| ORDER | OPEN PRICE | CURRENT PRICE | PROFIT/LOSS |

|---|---|---|---|

| 1 lot Buy | 1.30850 | 1.30800 | -50 USD |

| 2 lots Buy | 1.30600 | 1.30400 | -100 USD |

| 1 lots Buy | 1.30200 | 1.30400 | +200 USD |

Always spend time drafting your best strategy before you invest enough money in it. We would prefer you to be conscious that you may encounter situations where it fails to predict the market's direction and affords fake trading signals when using the most profound and complex system. Summing up on how does a Martingale strategy work in Forex trading? The Forex market doesn't regulate itself with an honest win or lose outcome with a fixed sum. We can limit price levels at which we take-profit or cut our loss. By doing so, we set our likely profit or loss as even amounts.

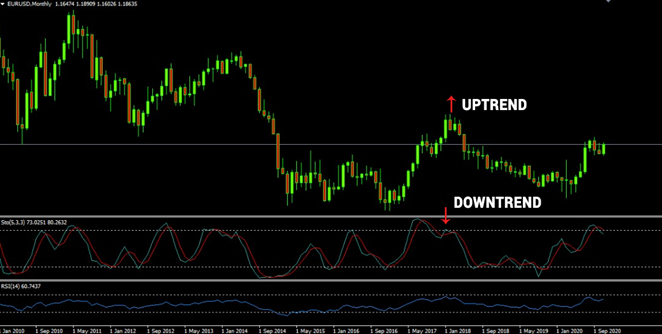

Shall we take a close look at the above chart?

Didn't you infer something out of it?

You might get it right; you can perceive that the stochastic oscillator gave us a hint that the market would reverse. Stochastic were over the 80 levels and curving lower, which is a Bearish indicator. Hence, with the upraise of the price at the 38.2% retracement level and stochastic proffering a sell signal, we're springing to build a good case for placing a sell order, or 'going short' as it is called in the trading industry.

Did you happen to watch the Sherlock Holmes series, off-course, a must-watch for a great experience, though? I don’t have anything to boast about the movie, yes just relating to the context. A profitable trader is like a detective building up facts based on multiple clues. We've opened two useful hints for taking a short position, but we're not done yet.

This Forex strategy can be applied across different time frames. For example, you could look for similar set-ups on a 30-minute chart instead of the four-hour chart we've used as an example.

It further supports the case for selling Bitcoin at the 38.2% Fibonacci retracement level. For short positions (sell trades), we want to see that the market is in a downtrend across multiple time frames. For long positions (buy trades), we want to see that the market is uptrend across numerous time frames.

Keep in mind that you'll get more signals on the shorter time frames, but they will be less reliable. Conversely, you will get fewer signals on the more extended time frames, but they will be more reliable.

Zooming out for the bigger picture and looking at the daily chart above, we can perceive that the trend is broadly downward on this timeframe also.

Get in with us to have an edge in the Forex Trading. Welcome Home!

© 2024 LOYALFXMARKETS. All Right Reserved.